New AFSA Survey Shows Consumer Credit Conditions Deteriorated in Q1 2024

Twice as Many Lenders Say Conditions “Worsened” Compared to “Improved”

The American Financial Services Association released its inaugural Consumer Credit Conditions (C3) Index , the first economic survey to specifically track what consumer credit lenders are seeing in the U.S. economic marketplace.

Looking at the first quarter of 2024, credit companies saw deteriorating conditions, with twice as many lenders reporting that conditions worsened over the first three months of the year. However, nearly 34% of lenders expect improved consumer credit conditions in next six months.

Most consumers and businesses need access to some form of credit to meet their financial needs, to cover unexpected expenses, or to gain some financial flexibility in tight financial times. The C3 Index provides insights from vehicle and mortgage lenders, credit card and personal installment companies, into where they see conditions for making that credit available for consumers to buy many of the goods and services they need.

The results show conditions facing consumer lenders deteriorated on balance in the first quarter of 2024, compared to the fourth quarter of 2023:

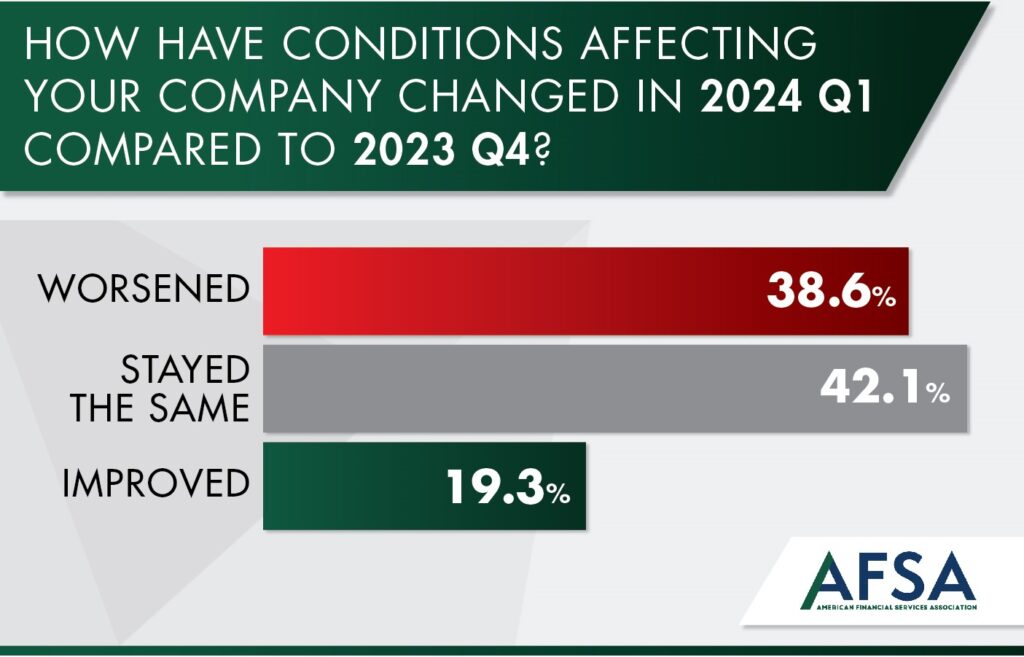

- Twice as many lenders said that business conditions worsened in Q1 (38.6 percent) versus improved (19.3 percent). The “Net Improving Index (NII)” – the percentage of those reporting improving conditions minus the percentage reporting worsening conditions – was -19.3 percent. Conditions were basically unchanged in Q1, according to 42.1 percent of survey participants.

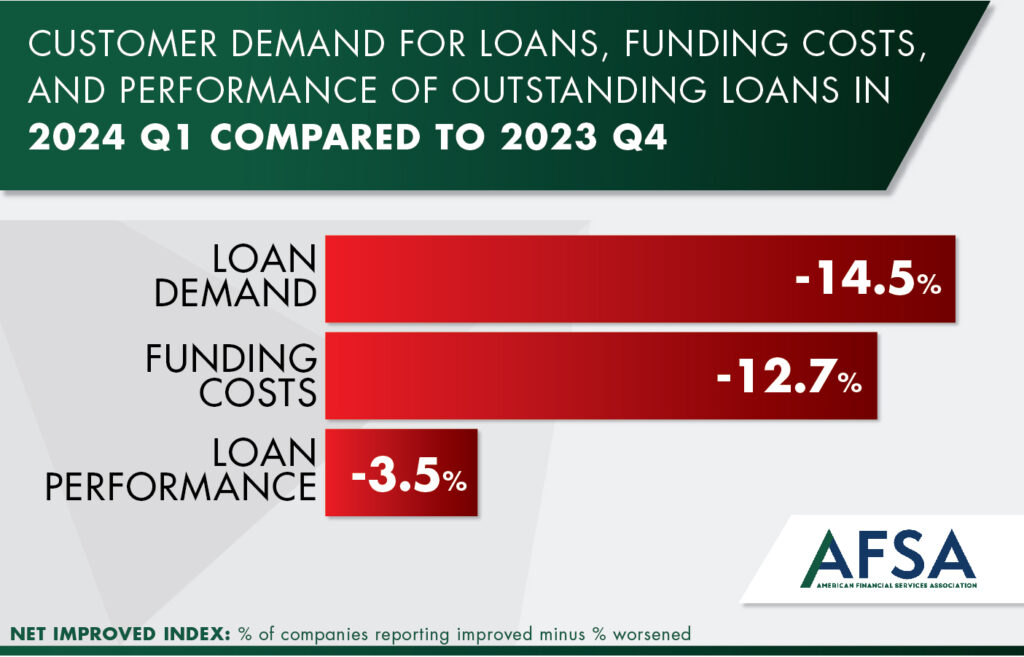

- Participants evaluated whether customer demand for loans, funding costs, and performance of outstanding loans improved, worsened, or stayed the same in Q1 2024 compared to Q4 2023. Every category saw indicators worsen. NIIs for loan demand, funding

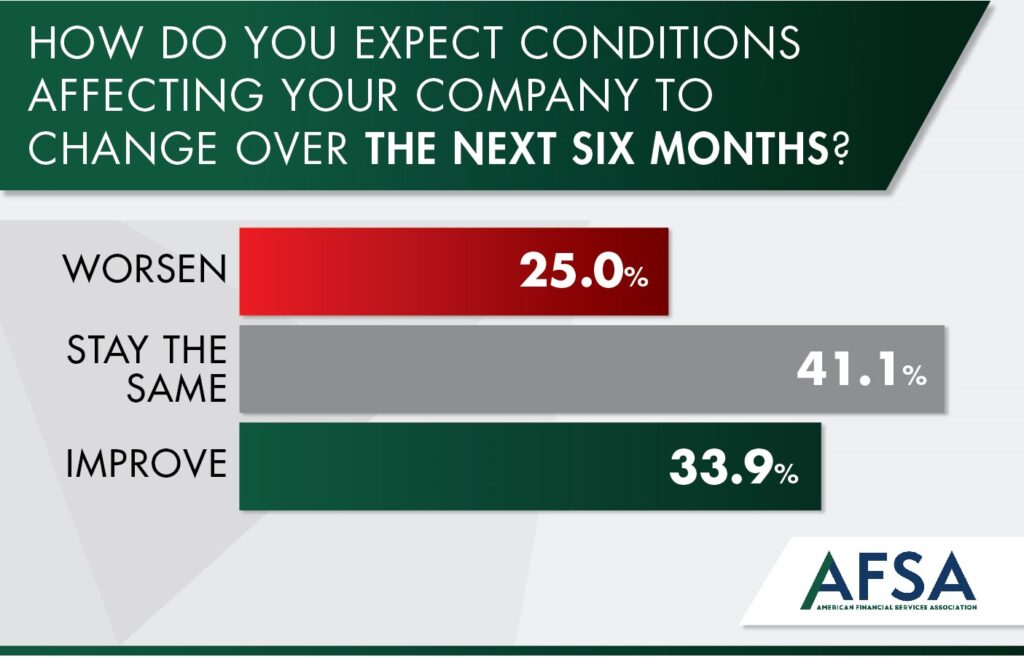

costs, and loan performance, respectively, measured -14.5, -12.7, and -3.5. - Lenders expressed a greater degree of forward-looking optimism over the next six months, with 33.9 percent saying conditions will improve vs. 25 percent expecting them to worsen, for an NII of +8.9.

- The NII for future loan demand outlook was +30.4, while the NII for the six-month funding cost outlook was +21.8. However, survey respondents remained pessimistic on balance (NII of -5.3) regarding the six-month outlook for the performance of outstanding loans.

“The C3 Index provides consumer-facing businesses with the perspectives of those who put money in the pockets of households that spend that money on groceries, clothing, school supplies, home repairs, vacations, just about everything.”

AFSA President & CEO bill Himpler

“The Q1 2024 survey results point to broad-based deterioration in consumer lending business conditions to start the year. It is encouraging, though, that some improvement is anticipated over the next several months as the headwinds facing the economy are expected to begin to ease.”

AFSA chief economist and VP for research TIM GILL